Earlier in Series, On of How to Avoid delays in your closing

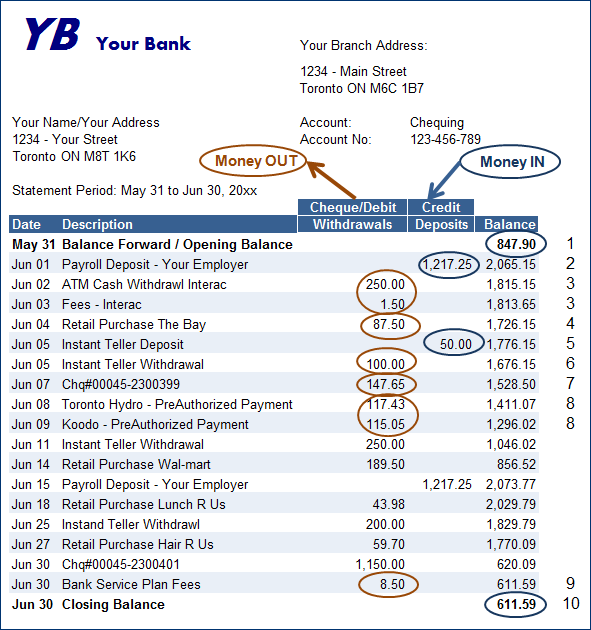

on a Home Loan, we mentioned just how important your credit is for when

you’re applying for a home loan. Aside from your FICO score, your assets are a

huge part to your loan approval. You must prove that you have the funds

to close and all funds must be sourced prior to issuing out a loan

approval.

For Residential

home loans you need 2 months of recent bank statements and for Commercial loans

we would need 3 months of recent bank statements.

For Example… If you apply in the month of October 2014

NuHome would need August 2014 - September 2014 bank statements for a

Residential Home Loan. Now, if you’re getting a Commercial Loan then you would

need the bank statements for July 2014 – September 2014.

Once we have received your

bank statements we will look through them thoroughly. Please be aware that any

cash deposits over $100.00 MUST be sourced.

Gifted Funds

A “gift” is allowed only

when it is given by an immediate family member. It must be considered a gift and NOT a loan

which will be requested to be paid back. If you received a gift from a family

member you must have a gift letter stating: who gave you the gift, when it came

to your account, and the donor must be willing to provide their bank statement.

The Donors bank statement will prove that the donor is in a good financial

position to gift you those funds. This is what we call the “Gift Test”. You may

scratch your head and say... ”Hmm. well why is their bank statement relevant?”

The Gift Test

Here’s why… Let’s say Uncle

Sam gives you a gift of $7,000.00 for closing cost but he only has $7,300 in

his account. There is no way he is any position to give you that gift. Based on

the ability to give a “Gift Test”, which is listed below, would fail because

this bank statement shows that he would be left with no money for himself.

Bank

of America

|

10/01/14 Cash Deposit

|

$700.00

|

|

10/05/14 Company Check Deposit

|

$3,000.00

|

|

10/15/14 Company Check Deposit

|

$4,000.00

|

|

10/16/14 Company Check Bonus Check

|

$300.00

|

|

10/17/14 Cash Withdrawal

|

$7,000.00

|

Current Balance $300.00

Now let’s talk about Cash

Deposits… If you or your donor has bank statements that have cash deposits of

$100.00 or more they must be sourced. If any cash deposits over $100.00 cannot

be sourced that amount will be backed out of total funds to close. Cash

deposits may be sourced by invoices or other donor’s gift letter.

For instance... If Uncle Sam

provides us with a bank statement, like the one that is listed below, and says

that a family member gave him that cash to deposit on October 1, 2014, then we

would need a gift letter from that family member along with a Gift Test.

Everything must add up and must be sourced.

Bank

of America

|

10/01/14 Cash Deposit

|

$700.00

|

|

10/05/14 Company Check Deposit

|

$3,000.00

|

|

10/15/14 Company Check Deposit

|

$4,000.00

|

|

10/16/14 Company Check Bonus Check

|

$300.00

|

|

10/17/14 Cash Withdrawal

|

$7,000.00

|

Current Balance $300.00

After we

have received all gift letters and source all cash, we will be able to issue

your loan approval. This final bank statement will need to be an original copy

or print out and signed copy from a bank representative. By us addressing these

issues ahead of time, we will make the loan process a lot faster once it goes

to underwriting. Keep in mind that if we do not receive the assets and gift letters,

then there will definitely be a delay in your loan process.

For more information on this subject please contact us by

phone 713-373-0345. Frank Marta NMLS# 245813 | 835196